CRM in Banking Sector- Challenges, Benefits and Automation Solutions

CRM in Banking Sector- Challenges, Benefits and Automation Solutions

In an age of information, it is important for all financial institutions to have a digital presence. A robust customer relationship management (CRM) system can help you connect with your customers at any time of day. CRM in banking helps retain existing customers and easily onboard new ones while delivering exceptional customer experience at every touchpoint.

In this guide, we will provide valuable insights into leveraging customer relationship management in banking and explore modern banking CRM solutions that transform how financial services organizations operate.

What is CRM in Banking?

In the competitive banking industry, understanding and meeting customer expectations becomes a challenge. This is where Customer Relationship Management (CRM) comes into play. CRM in banking refers to the practices, CRM software, and tools used to manage customer relationships and improve interactions with customers. It involves collecting and analyzing customer data to gain insights and provide personalized customer experiences.

A banking CRM system helps banks understand customer behavior, segment their customer base, and offer tailored products and personalized services. It also supports effective marketing efforts, cross-selling, and customer service. By leveraging a banking CRM platform, banks can strengthen customer relationships, enhance customer satisfaction, and drive revenue growth. Now, let us learn the importance of CRM in banking:

Understanding the Importance of CRM in Banking

CRM is important in banking as it helps build strong relationships with customers, benefiting the financial services industry across retail banking and corporate segments.

- By utilizing banking CRM tools and strategies, financial institutions can gather valuable customer data, track customer interactions, and analyze customer behavior. Banks use this customer information to anticipate customer needs, so they can deliver personalized services and CRM solutions tailored to individual preferences.

- It improves customer satisfaction by providing efficient and effective customer service. Financial institutions can gain an advantage and increase profitability by focusing on client relationships and using CRM practices with seamless integration across channels.

- A banking CRM system provides banks with valuable insights and advanced analytics, along with security and compliance tools for a high level of information security. Banks can securely analyze customer data to identify trends, measure campaign effectiveness, and make informed decisions regarding marketing efforts, product development, and customer segmentation through centralized data management.

- CRM systems provide a centralized CRM platform for managing customer support requests. Customer service representatives and sales teams can access customer information quickly, resolve issues efficiently, and deliver personalized customer experiences, resulting in improved customer experience across all banking processes.

Benefits of CRM in Banking

By leveraging a banking CRM solution, banks can unlock the true potential of their customer relationships, providing superior customer experience, driving profitability, and staying ahead in a competitive landscape.

CRM brings a plethora of benefits to the banking industry and financial services sector:

- Enhanced Customer Service: Sales teams and support staff can manage customer relationships more effectively with complete customer information at their fingertips.

- Improved Customer Retention: Banking CRM software enables banks to improve customer retention through proactive engagement and personalized services.

- Efficient Lead Management: CRM solutions streamline operations for sales teams, automating manual tasks and improving sales processes.

- Effective Cross-Selling and Upselling: Advanced analytics help identify opportunities based on customer behavior and customer needs.

- Data-Driven Decision Making: Financial institutions can leverage customer data for smarter business processes.

- Improved Operational Efficiency: Workflow automation and automated workflows reduce manual tasks and streamline banking operations.

- Regulatory Compliance: Security and compliance tools help in maintaining regulatory compliance and protect customer information from data security concerns.

Why Should Banks Consider CRM?

Financial institutions should consider a banking CRM solution because it allows them to better understand and serve their customers while meeting evolving customer expectations.

By implementing CRM strategies and a robust CRM platform, banks can gather valuable customer data about their customer's preferences, customer behavior, and customer needs. You can then use this data to personalize sales and marketing efforts, improve customer service, and ultimately enhance customer satisfaction and loyalty.

A banking CRM system addresses traditional banking processes by helping banks streamline operations, including customer onboarding and customer account management, for more efficiency and cost savings.

Overall, CRM in banking is essential for building strong client relationships and staying competitive in the banking industry. The right banking CRM platform enables banks to anticipate customer needs and deliver personalized customer experiences consistently.

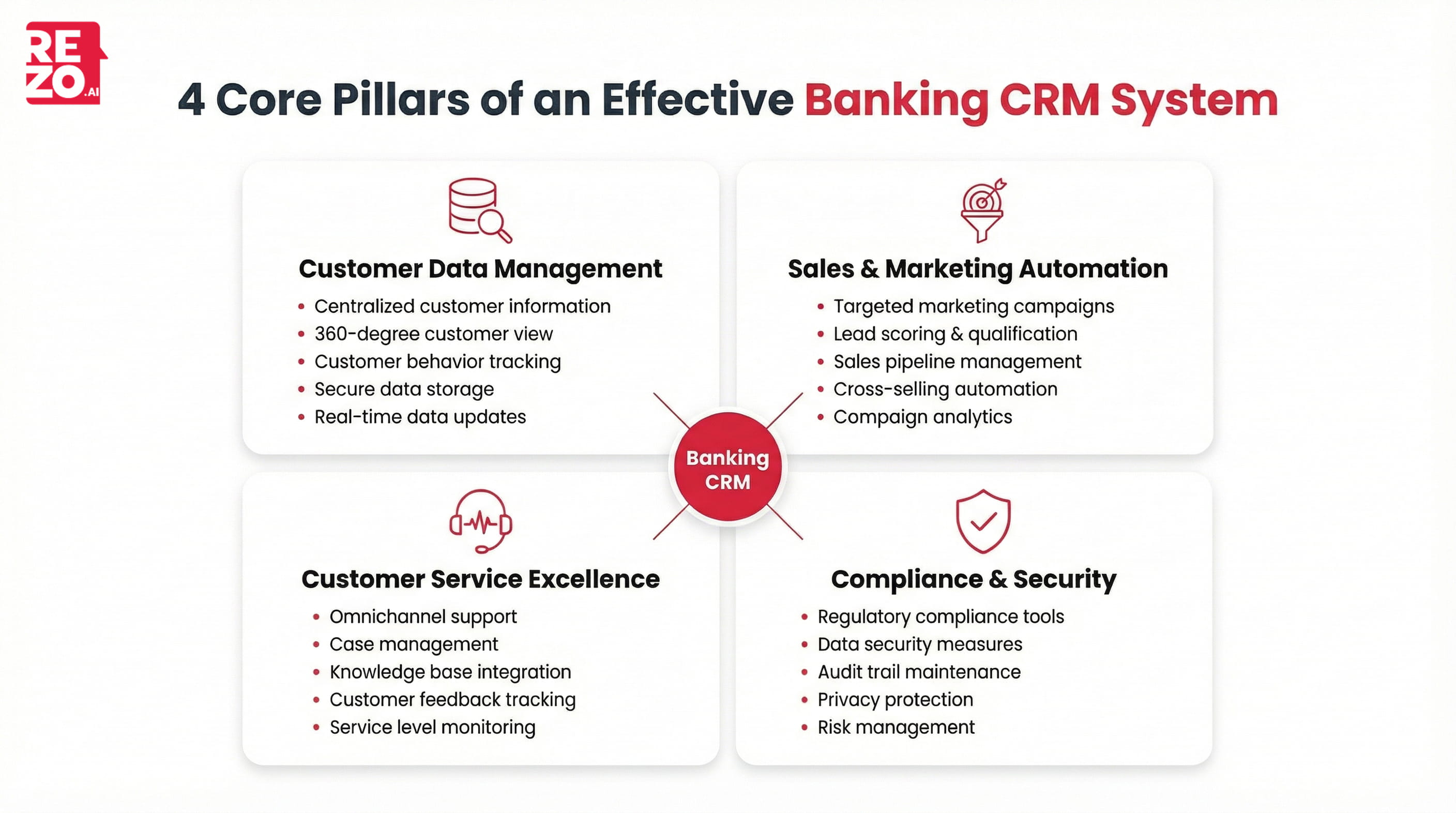

Key Features of Modern Banking CRM Solutions

When evaluating a CRM solution for financial services, consider these key features:

- Centralized Data Management: A unified CRM platform that consolidates customer information across all touchpoints.

- Workflow Automation: Automated workflows that eliminate manual tasks and improve efficiency in banking processes.

- Data Security: Robust data security measures and compliance tools to protect customer information and address data security concerns.

- Seamless Integration: Ability to integrate with existing banking systems and financial processes.

- Advanced Analytics: Tools to analyze customer behavior and improve customer experience through data-driven insights.

- Financial Services Cloud: Specialized solutions like Salesforce Financial Services Cloud designed specifically for financial institutions in retail banking and wealth management.

Example of CRM in Banking

Several use cases demonstrate its value and effectiveness. Here are a few notable examples of CRM in banking:

- Customer Onboarding and Account Opening: Banking CRM systems streamline the customer onboarding process through workflow automation, automating data collection, verification, and document management. This simplifies the customer account opening process, reduces paperwork, and enhances the customer experience.

- Personalized Marketing Campaigns: Banking CRM helps sales teams create targeted marketing campaigns by segmenting customers and coordinating sales and marketing efforts. By analyzing customer data and customer behavior, banks can deliver personalized offers, promotions, and recommendations based on customer preferences, increasing the effectiveness of marketing efforts.

- Customer Service and Support: The CRM system enables banks to provide efficient and personalized customer service. Representatives have access to customer profiles, transaction history, and communication records, allowing them to address customer inquiries and resolve issues quickly and effectively.

- Cross-Selling and Upselling: A banking CRM solution helps financial institutions identify cross-selling and upselling opportunities. Banks can use customer data and transaction history to offer appropriate products or services, increasing the likelihood of additional sales.

- Complaints and Case Management: CRM solutions assist in managing customer complaints and cases. Banks can track and prioritize customer issues through automated workflows, ensuring timely resolution and effective communication throughout the sales processes. This helps improve customer satisfaction and loyalty.

- Customer Analytics and Insights: Banking CRM tools provide financial services organizations with valuable customer analytics and insights. Banks can improve customer satisfaction, loyalty, and profitability by analyzing customer accounts and customer behavior to find patterns and opportunities.

- Relationship Management and Loyalty Programs: Customer relationship management in banking helps manage customer relationships and nurture client relationships. Banks can monitor customer preferences to identify loyal customers and create personalized loyalty programs, promoting long-term customer loyalty and helping improve customer retention.

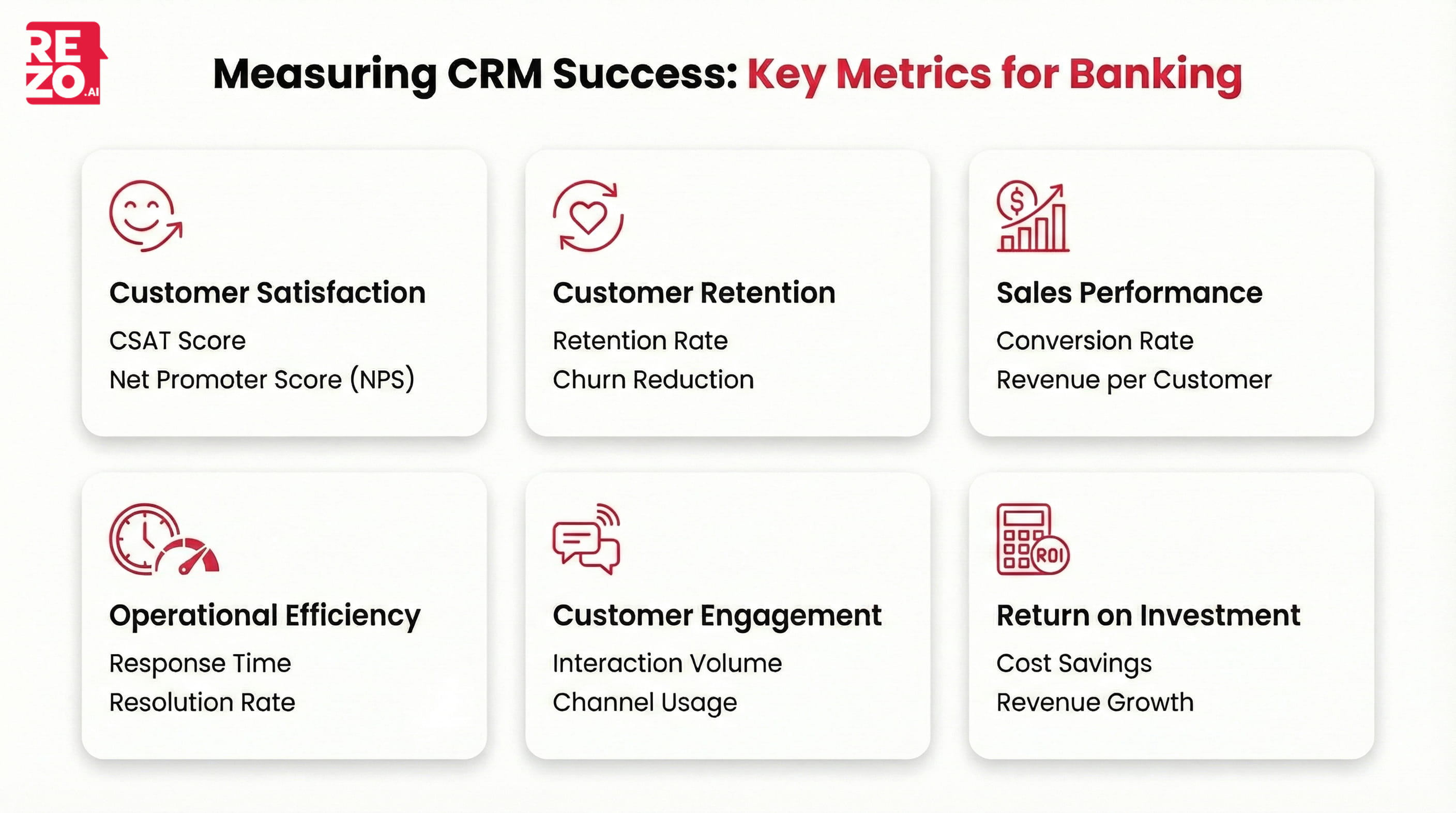

Measuring the Success of Your CRM Initiatives in the Banking Sector

Measuring the success of your CRM efforts in the banking sector is important. It ensures that you are reaching your goals and getting the most out of your CRM solution investment. You can use several key metrics to evaluate the effectiveness of your banking CRM efforts.

- You can measure customer satisfaction through surveys, feedback forms, and customer reviews, which are important metrics for evaluating customer experience.

- Customer retention is a key metric. It measures how many customers stay with your bank over time and helps improve customer retention strategies.

- To understand the impact of your CRM system on revenue, monitor the number of new customers you acquire through sales teams. Also, track the average value of their purchases and assess the overall profitability of your customer group.

- You can track and analyze these numbers through your CRM platform. This will help you find areas to improve. Additionally, you can use data to make better decisions for your banking CRM strategies.

CRM is important in banking, changing how financial institutions communicate with customers and improving results. Using CRM in banking helps understand customer needs, provide personalized customer experiences, and create lasting relationships.

CRM is important in banking because it helps create good relationships with customers, which benefits the entire financial services industry. To have an effective CRM strategy, you need advanced technology with seamless integration that can handle the complexity of customer expectations.

With an AI-powered autonomous contact center, you can automate conversational processes and increase customer engagement by 40%. Through fast-track query resolution, your customers can easily navigate through the buying process.

FAQs on CRM in Banking

What is CRM and its roles?

CRM is a strategy, process, and technology used by financial institutions and businesses to manage customer relationships and improve customer experience. Its roles include customer data management, segmentation, and sales pipeline management through a centralized CRM platform, leading to stronger relationships and improved business outcomes.

What are the advantages of CRM?

Advantages of a banking CRM solution include enhanced customer relationships, targeted marketing campaigns, improved customer service, increased cross-selling opportunities, data-driven decision making, and streamlined operations through workflow automation, leading to increased customer satisfaction, loyalty, and sustainable growth across the financial services sector.

Frequently Asked Questions (FAQs)

Take the leap towards innovation with Rezo.ai

Get started now